Indicators on Affordable Bankruptcy Lawyer Tulsa You Should Know

A Biased View of Which Type Of Bankruptcy Should You File

Table of ContentsThe 15-Second Trick For Tulsa Bankruptcy Legal ServicesIndicators on Bankruptcy Lawyer Tulsa You Should KnowSome Of Bankruptcy Lawyer TulsaThe Buzz on Top-rated Bankruptcy Attorney Tulsa OkRumored Buzz on Affordable Bankruptcy Lawyer TulsaThe Greatest Guide To Chapter 7 Bankruptcy Attorney TulsaThings about Tulsa Debt Relief Attorney

Advertisement As a daily consumer, you have 2 major phases of personal bankruptcy to pick from: Phase 7 and Chapter 13. We very recommend you first gather all your financial records and consult with a lawyer to understand which one is finest for your situation.The clock starts on the filing date of your previous situation. If the courts disregard your insolvency proceeding without prejudice (significance without suspicion of fraudulence), you can refile instantly or submit a motion for reconsideration. However, if a court disregarded your situation with bias or you willingly rejected the situation, you'll need to wait 180 days prior to submitting again.

The book uses advice, ideas, and economic management lessons geared towards helping the viewers highlight strengths, recognize bad moves, and take control of their finances. Jennifer's most important monetary suggestions to her buddies is to always have an emergency fund.

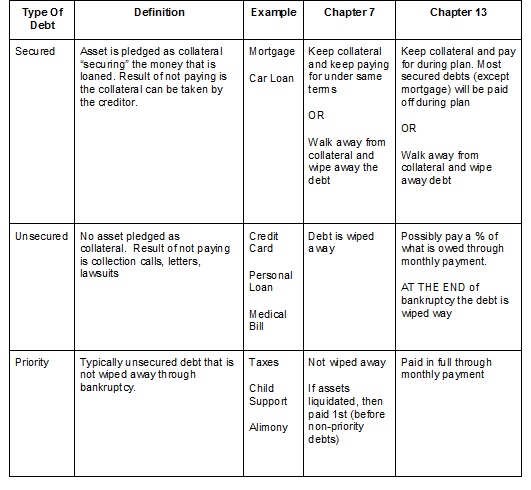

All debts are not developed equal. Some financial obligations obtain popular standing via the regulation financial debts like tax obligations or kid support. Some debts are a priority based on that is owed the debt. For circumstances you may feel a lot extra obligated to pay a relative you owe cash to or to pay the physician that brought you back to wellness.

Rumored Buzz on Bankruptcy Lawyer Tulsa

And since of this lots of people will certainly inform me that they do not want to include specific financial obligations in their bankruptcy case. It is completely reasonable, yet there are 2 troubles with this.

Despite the fact that you might have the very best purposes on paying back a specific financial debt after insolvency, life happens. I do not doubt that you had respectable purposes when you sustained every one of your debts. The circumstances of life have led you to bankruptcy since you could not pay your financial debts. So, despite the fact that you wish to pay every one of your debts, occasionally it does not work out this way.

Most frequently I see this in the clinical area. If you owe a physician cash and the financial debt is discharged in bankruptcy, do not be amazed when that medical professional will no longer have you as an individual.

If you desire those braces to come off at some point, you will likely require to make some kind of repayment setup with the excellent doctor. The alternative in both scenarios is to seek a new doctor. To respond to the inquiry: there is no picking and picking, you should reveal all financial debts that you owe since the moment of your personal bankruptcy filing.

Rumored Buzz on Chapter 7 - Bankruptcy Basics

If you owe your household cash before your case is submitted, and you rush and pay them off and after that expect to submit bankruptcy you ought to also expect that the bankruptcy court will connect to your family members and try and Discover More get that cash back. And by shot I suggest they will sue them and make them go back to the money (that won't make things awkward at all!) That it can be dispersed amongst all of your financial institutions.

There are court filing fees and several individuals hire a lawyer to browse the complex procedure. Because of this, you require to make certain that you can afford these costs or discover options for cost waivers if you certify. Not all debts are dischargeable in bankruptcy, so before declaring, it is necessary that you clearly comprehend which of your debts will be discharged and which will certainly stay.

There are court filing fees and several individuals hire a lawyer to browse the complex procedure. Because of this, you require to make certain that you can afford these costs or discover options for cost waivers if you certify. Not all debts are dischargeable in bankruptcy, so before declaring, it is necessary that you clearly comprehend which of your debts will be discharged and which will certainly stay.Tulsa Ok Bankruptcy Attorney for Dummies

If you're married or in a domestic partnership, your insolvency declaring can additionally influence your companion's funds, particularly if you have joint financial debts or shared properties. Review the effects with your companion and take into consideration inquiring on exactly how to safeguard their monetary rate of interests. Personal bankruptcy must be deemed a last hope, as the impact on your funds can be significant and durable.

Before you make a decision, ask on your own these questions and consider your other options. That way, you're far better prepared to make an educated choice. Angelica Leicht is senior editor for Handling Your Cash, where she writes and edits posts on a series of individual money topics. Angelica previously held editing and enhancing roles at The Straightforward Buck, Passion, HousingWire and other financial publications.

In 2017, there were 767,721 personal insolvency filingsdown from the 1.5 million submitted in 2010. Several research studies suggest that medical financial obligation is a significant root cause of a number of the insolvencies in America. Personal bankruptcy is made for people captured in extreme economic situations. If you have excessive financial obligation, insolvency is a federal court process designed to aid you eliminate your financial debts or settle them under the defense of the personal bankruptcy court.

Some Known Incorrect Statements About Which Type Of Bankruptcy Should You File

The interpretation of a borrower that may submit insolvency can be found in the Personal bankruptcy Code. Efforts to regulate your spending have fallen short, also after going to a credit rating therapist or trying to adhere to a financial obligation combination plan. You are unable to meet financial debt obligations on your existing earnings. Your efforts to function with creditors to establish up a financial debt repayment strategy have actually not functioned (Tulsa bankruptcy lawyer).

The interpretation of a borrower that may submit insolvency can be found in the Personal bankruptcy Code. Efforts to regulate your spending have fallen short, also after going to a credit rating therapist or trying to adhere to a financial obligation combination plan. You are unable to meet financial debt obligations on your existing earnings. Your efforts to function with creditors to establish up a financial debt repayment strategy have actually not functioned (Tulsa bankruptcy lawyer).There are court filing fees and many people hire a lawyer to navigate the complicated process., so prior to declaring, it's essential that you clearly understand which of your financial debts will certainly be released and which will certainly stay.

Some Ideas on Chapter 7 Bankruptcy Attorney Tulsa You Should Know

If you're wed or in a residential partnership, your insolvency filing could additionally impact your companion's funds, specifically if you have joint financial debts or shared assets. Go over the effects with your partner and take into Tulsa OK bankruptcy attorney consideration consulting on just how to safeguard their financial passions. Bankruptcy needs to be considered as a last resort, as the effect on your financial resources can be significant and durable.

Before you make a decision, ask on your own these questions and evaluate your various other alternatives. Angelica previously held editing duties at The Simple Dollar, Passion, HousingWire and various other financial publications. Tulsa bankruptcy attorney.

Little Known Questions About Tulsa Ok Bankruptcy Attorney.

Numerous studies suggest that medical financial debt is a significant reason of several of the personal bankruptcies in America. If you have too much financial obligation, personal bankruptcy is a federal court procedure made to aid you remove your financial obligations or repay them under the defense of the insolvency court.

Efforts to control your costs have stopped working, even after checking out a credit therapist or attempting to stick to a financial obligation loan consolidation strategy. Your attempts to function with creditors to set up a debt repayment plan have not worked.